“I heard the Fed raised mortgage rates.”

You wouldn’t believe how often I hear that statement. It is one of the biggest myths I have to dispel with borrowers. Especially with borrowers who are concerned over looming interest rate hikes. Well, dig in for a few minutes and you’ll be able to channel your inner Alan Greenspan at your next cocktail party or the next time you are considering a mortgage.

First off, let me be perfectly clear…the Federal Reserve (The Fed) does not control mortgage rates. They only control the Federal Funds Rate (FF). Without getting into too much detail, The Fed manipulates this rate up and down to stabilize employment and inflation. This very short-term rate either encourages or discourages borrowing, which can ultimately stimulate or suppress the economy. For instance, The Fed would raise the FF due to increasing prices on goods and services (aka inflation), to choke off consumer spending/demand thereby controlling inflationary pressures.OK, so if the Fed has no direct impact on mortgage rates, what does? Lots of things do, but most importantly it is inflation. Ah, see the correlation now? The Fed manages rates to control inflation and inflation is a key determinant on mortgage rates.

A key question now is, why does inflation have such an impact on mortgage rates? Well, a mortgage is a 30 year commitment, and thus, is highly affected over time by changes to values. In other words, periods of high inflation erode the value of a 30yr mortgage, therefore interest rates have to increase to offset that impact. So, when The Fed begins raising interest rates they are doing so because of either the presence of inflation or the imminent threat of inflation exceeding 2.0% annually. Over the long-term mortgage rates will tend to track the Feds moves, but not always.

The short-term curve ball! Here is the point I have been leading up to…when The Fed begins an interest rate increase cycle, much like they are starting now, they are taking proactive steps to hedge off future inflation. When they do that, mortgage investors are happy that future inflation is being curtailed to protect their long-term value. Thus, historically, when the Fed has raised FF you will see a short-term (i.e. three day to three week) period where mortgage rates actually drop.

So, the next time you hear someone say I hear the Fed raised mortgage rates you can be the smartest one in the room and say, “Well, not exactly!”

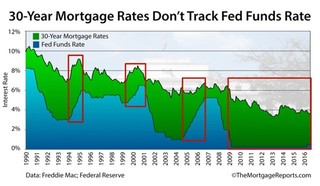

For fun (no seriously, this is fun for me), check out this chart a statistics below:

ABOVE, I have highlighted four interesting time frames of Fed interest rates changes against 30-year mortgage rates.

Feb ’94 – Feb ’95: Fed Funds increased 3.00% during this period. Mortgage rates increased approximately 2.00% from 7.25% to 9.25% (whoa!). Proving an increasing FF rate is not directly pegged. The key to this time frame is that inflation during this time, as measured by the Feds most watched inflation index the Personal Consumption Expenditure (PCE) was over 2.5% over the preceding 12 months before they began raising rates. Mortgage rates spike as a result of inflation!

June ’99 – May ’00: Fed Funds increased 1.75% during this period. Mortgage rates followed as a result of the PCE going from 1.72% to 2.22% during this concurrent time.

June ’04 – June ’06: Fed Funds increase 4.25% in this 24 month period. This was the “crazy time” of mortgage borrowing. Inflation got a bit out of hand because anyone with a pulse could get a loan. Interesting (pun intended) enough mortgage rates were mostly flat during this time because the Fed was being so aggressive raising rates and staying ahead of inflation. This is the perfect example when rate increases have little to even a negative effect on mortgage rates.

Dec ’08 – present: FF have been absolutely flat. You can see there variation in mortgage rates over the last eight years. The influence in rates has been inflation, war, geo-political financial crisis, and other type of Fed stimulus, and much more. Coincidently and very importantly, in Dec ’15 when the Fed last raised the FF by .25%, mortgage rates proceeded to drop from 4.00% to approximately 3.625% in less than 30 days.

Dirk Walker

Loan Consultant

NMLS# 276166

Boulder

1881 9th Street, suite 115

Boulder, CO 80302

Main: (800) 450-2010 x3608

Direct: (303) 562-9823

Fax: (303) 595-5381

E-Mail: dirk.walker@nafinc.com